Financial Highlights & Indicators

RM’000 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

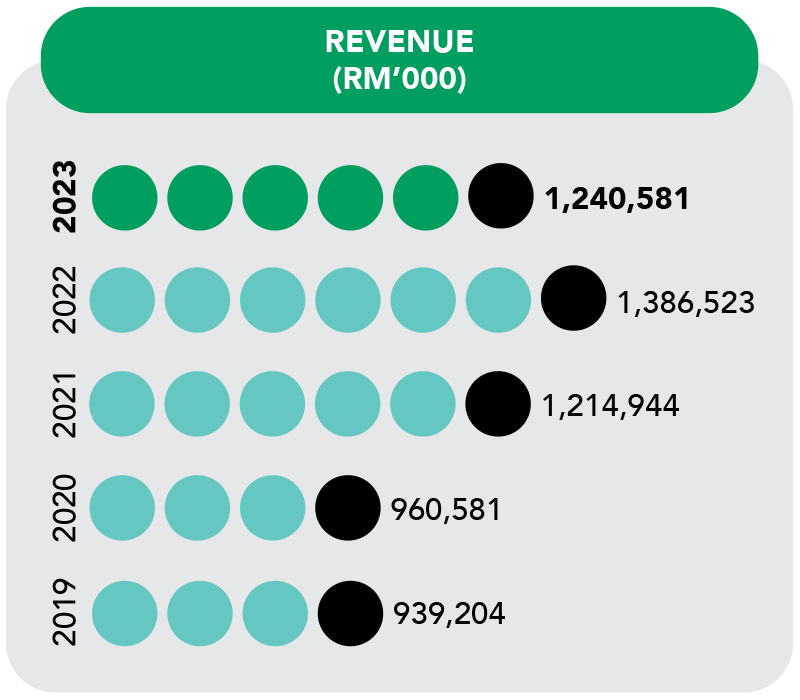

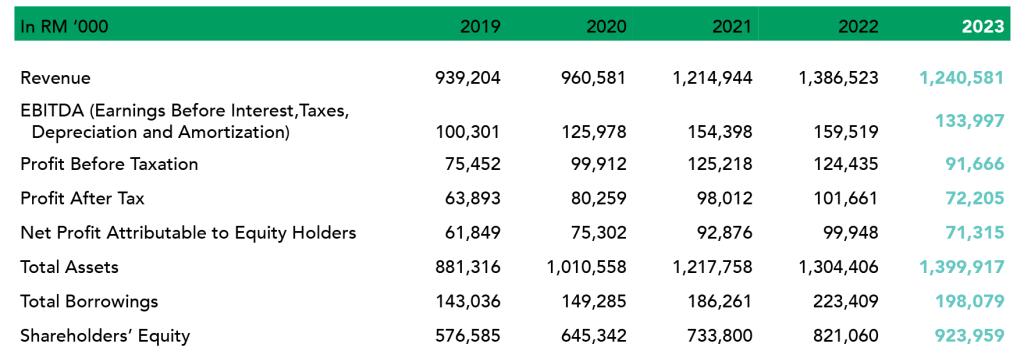

Revenue | 831,203 | 861,615 | 939,204 | 960,581 | 1,214,944 |

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | 68,085 | 73,051 | 100,301 | 125,978 | 154,398 |

Profit Before Taxation | 50,682 | 51,972 | 75,452 | 99,912 | 125,218 |

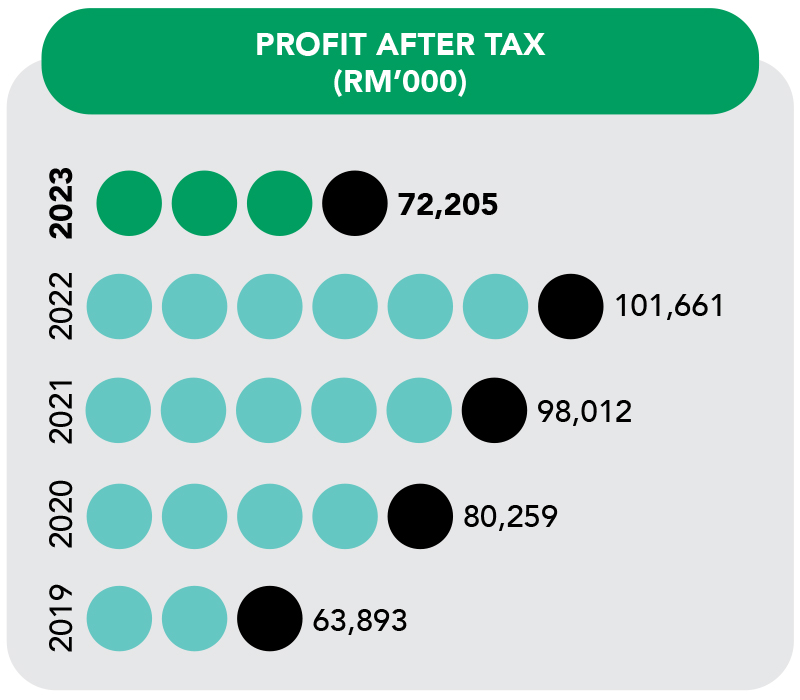

Profit After Tax | 42,707 | 43,610 | 63,893 | 80,259

| 98,012 |

Net Profit Attributable to Equity Holders | 41,897 | 43,682 | 61,849 | 75,302

| 92,876 |

Total Assets | 685,451 | 739,312 | 881,316 | 1,010,558 | 1,217,758 |

Total Borrowings | 75,693 | 126,926 | 143,036 | 149,285

| 186,261 |

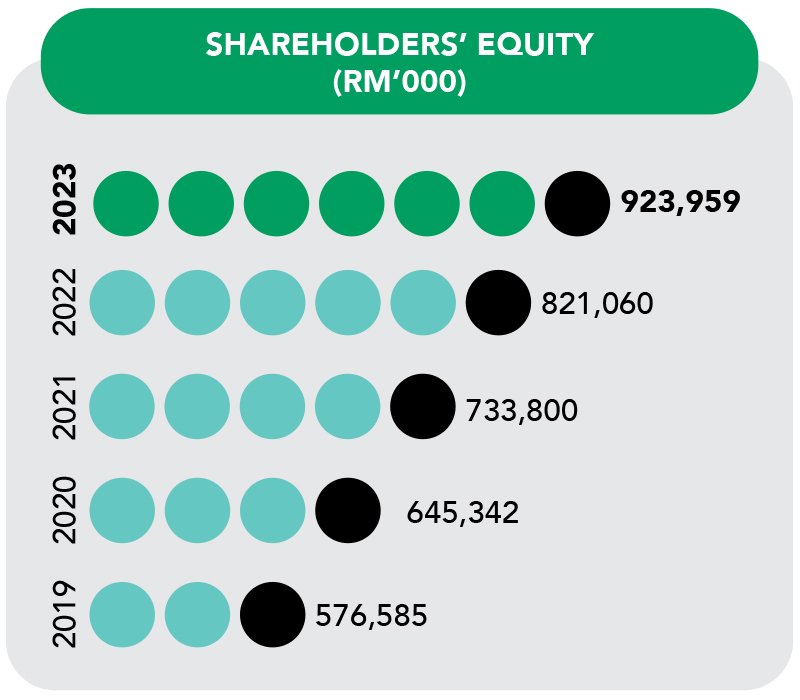

Shareholders’ Equity | 466,253 | 494,848 | 576,585 | 645,342

| 733,800 |

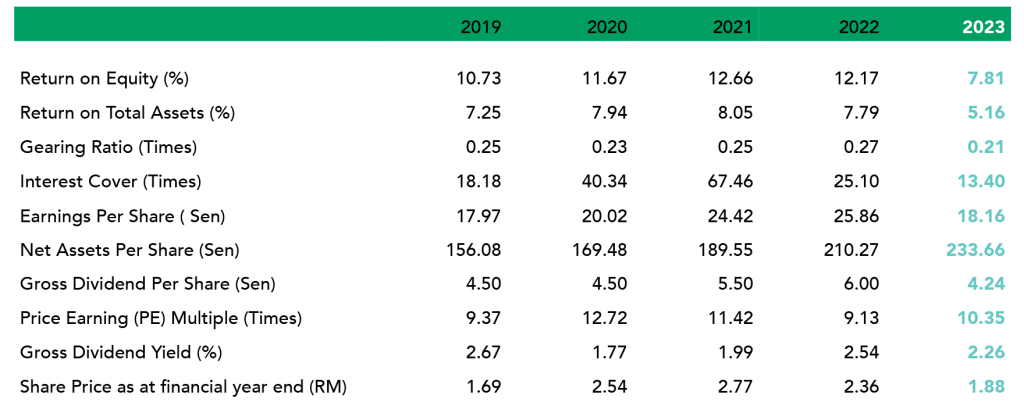

2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

Return on Equity (%) | 9.16 | 8.83 | 10.73 | 11.67

| 12.66 |

Return on Total Assets (%) | 6.23 | 5.90 | 7.25 | 7.94

| 8.05 |

Gearing Ratio (Times) | 0.16 | 0.26 | 0.25 | 0.23

| 0.25 |

Interest Cover (Times) | 28.41 | 15.92 | 18.18 | 40.34

| 67.46 |

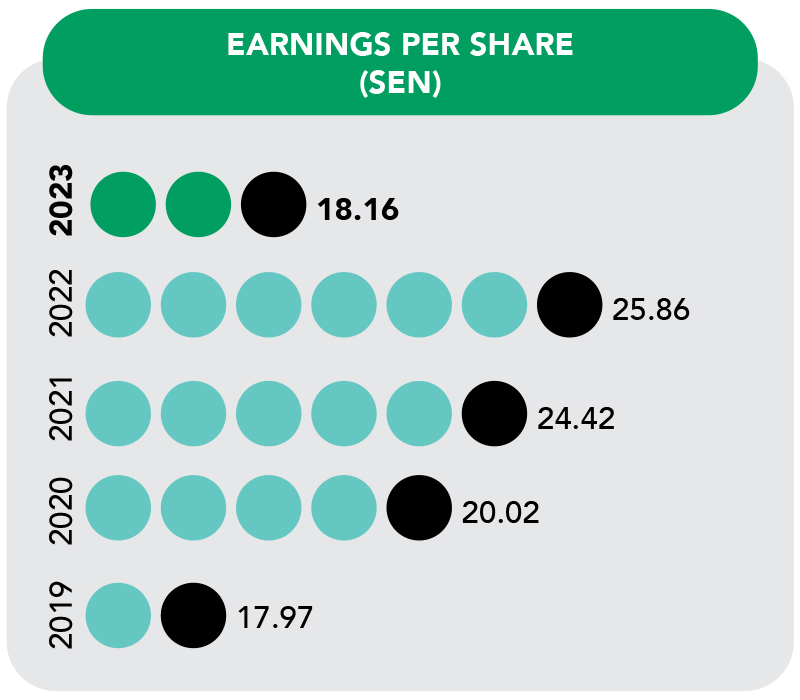

Earnings Per Share (Sen)* | 15.94

| 16.02

| 17.97

| 19.97

| 24.42 |

Net Assets Per Share (Sen)* | 172.35

| 181.35

| 156.08

| 169.48

| 189.55 |

Gross Dividend Per Share (Sen)* | 4.00

| 4.00

| 4.50

| 4.50

| 5.50 |

Price Earning (PE) Multiple (Times)* | 13.26

| 6.87

| 9.37

| 12.72

| 11.42 |

Gross Dividend Yield (%)* | 1.89 | 3.64 | 2.67 | 1.77

| 1.99 |

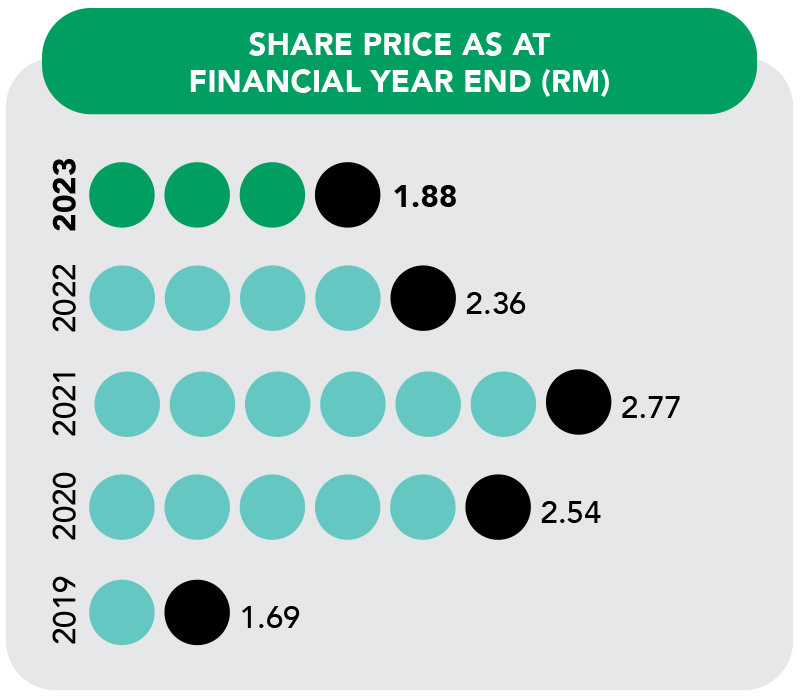

Share Price as at Financial Year End (RM)* | 2.12

| 1.10

| 1.69

| 2.54

| 2.77 |

Remark:

* The prior year earning per share, net assets per share, gross dividend per share, price earning, gross dividend yield and share price is computed based on enlarged number of ordinary shares in issue after adjusting for the effects of bonus issue restrospetively